capital gains tax proposal washington state

Washingtons legislature passed a new capital gains tax in April Engrossed Substitute SB. Washington has worst local taxes in nation The money collected from the capital gains tax will reduce taxes for 300000 small businesses reduce property taxes.

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

Effective budgeting requires revenues to be predictable and relatively stable.

. All projections err to some degree and no revenue sources are immune to economic conditions. If and when it is approved there it will go on to the governors desk for a signature. If we accept the states argument that its.

Senate Bill 5096 levies a 7 tax on Washington residents annual long-term capital gains exceeding 250000. Of course all the states Office of Financial Management can do is assume that capital gains will increase every year whereas in practice capital gains are exceedingly. The latest public hearing on a move to establish a capital gains tax prompted more than 3900 people to sign into the states legislative website.

This proposal is effective January 1 2022 with the first capital gains tax return due April 15 2023. The 2021 Washington State Legislature recently passed ESSB 5096 RCW 8287 which creates a 7 tax on the sale or exchange of long-term capital assets such as stocks bonds business interests or other investments and tangible assets. The CGT imposes a 7 long-term capital gains tax on the voluntary.

State of Washington that the capital gains excise tax ESSB 5096 does not meet state constitutional requirements and therefore is unconstitutional and invalid. Exempt from the proposed Washington capital gains tax. Timber A taxpayer who sells or cuts timber and elects to treat the activity as a capital gain for federal tax purposes under Section.

Senate Bill 5096 sponsored by Sen. Jay Inslee on Thursday unveiled a budget proposal for 576 billion in general fund spending and a capital gains tax for the 2021-23 biennium. FOR IMMEDIATE RELEASE.

No capital gains tax currently exists in Washington at the state or local. Governor Inslee signed Washingtons new capital gains tax the tax or the CGT into law on May 4 2021. Washington state Gov.

The state would apply a 9 percent tax to capital gains earnings above 25000 for individuals and. Tech workers business owners public policy advocates and private citizens weighed in this week in favor of and against a proposed capital gains tax in Washington state. This tax only applies to individuals.

Washingtons capital gains tax is designed as a direct tax not an indirect one. SB 5096 would impose a 9 income tax on capital gains in Washington state. It taxes out-of-state earnings and out-of-state activity.

Inslee proposed in his 2021-23 budget see Gov. To see what Gov. Inslees 21-23 capital gains tax proposal.

Jay Inslee signed a critical piece of tax reform legislation. Washington State Capital Gains Tax. Governor Inslee is proposing a capital gains tax on the sale of stocks bonds and other assets to increase the share of state taxes paid by Washingtons wealthiest taxpayers.

The expectation is that the capital gains tax proposal will pass in the state House. Yes capital gains on real estate are taxable under the federal income tax. Washington Enacts New Capital Gains Tax for 2022 and Beyond.

A warning from France on wealth taxes. New state tax proposals examined by Jason Mercie r. There are significant exclusions which prevent the tax from falling on most sellers the first 250000 in gains are exempt for single filers or 500000 for joint filers but beyond the exclusion amount.

OLYMPIA Earlier today Gov. This information relates to a capital gains tax as proposed in 2018. The Washington Repeal Capital Gains Tax Measure is not on the ballot in Washington as an Initiative to the People a type of initiated state statute on November 8 2022.

17OLYMPIA A controversial capital gains tax proposal passed out of the Senate Ways and Means committee Tuesday night clearing its first hurdle on the way to.

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal

House Democrats Propose Hiking Capital Gains Tax To 28 8

House Democrats Tax On Corporate Income Third Highest In Oecd

New Taxes Will Hit America S Rich Old Loopholes Will Protect Them The Economist

France Tax Income Taxes In France Tax Foundation

Navigating Washington State S New Capital Gains Tax Coldstream Wealth Management

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

State Corporate Income Tax Rates And Brackets Tax Foundation

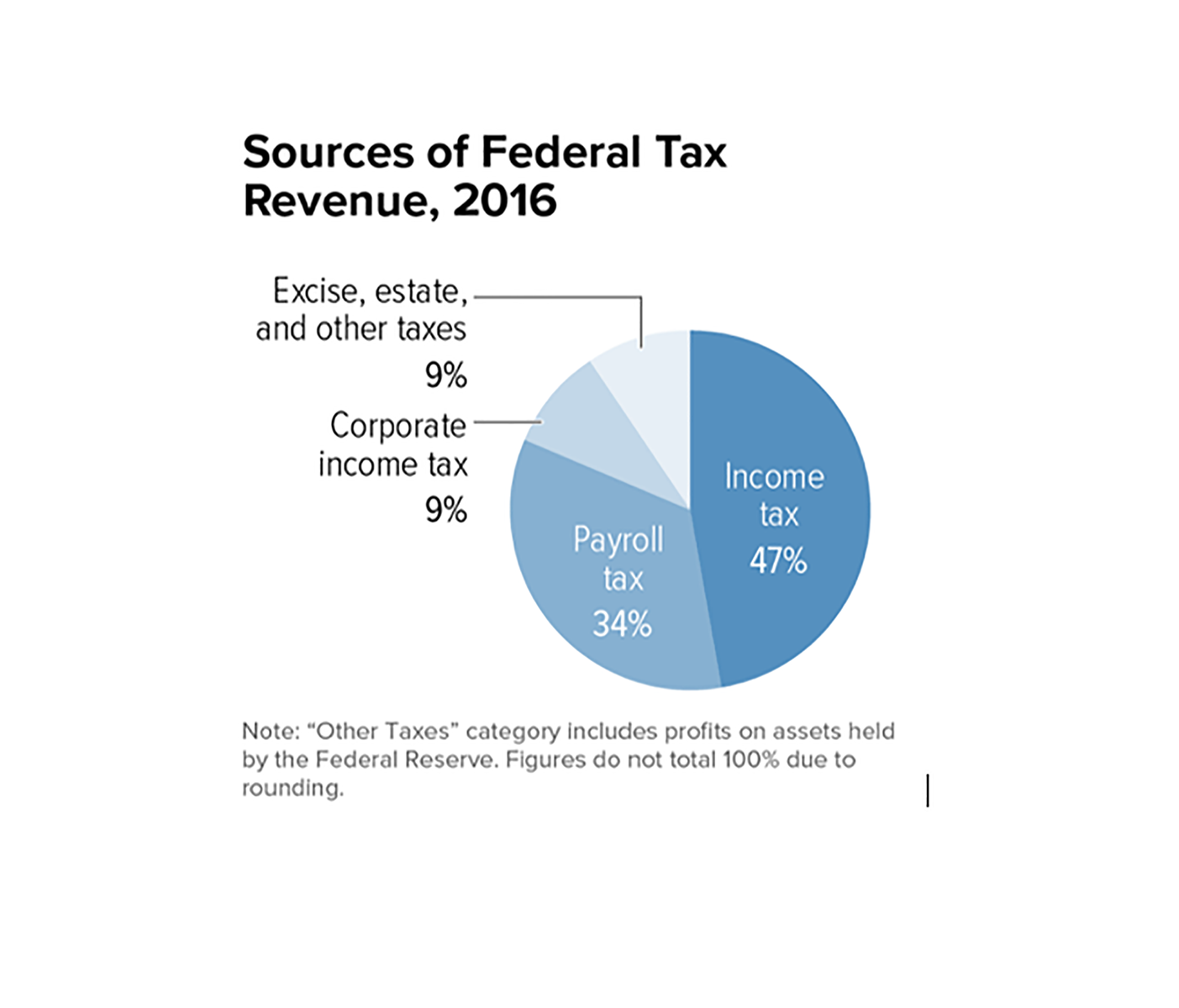

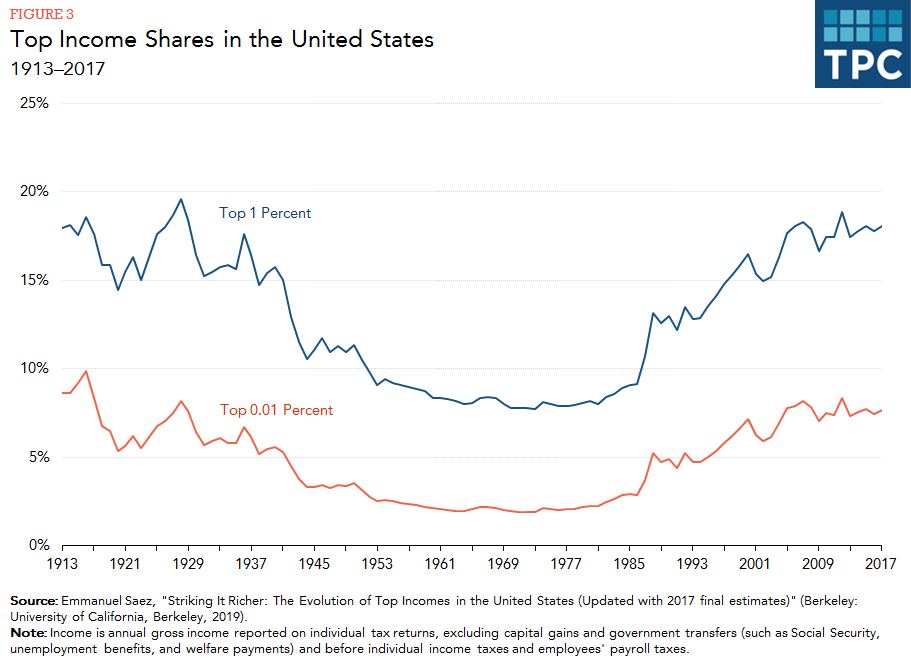

How Do Taxes Affect Income Inequality Tax Policy Center

Controversial Capital Gains Tax Spooks Wealthy Washington Residents As Some Unload Their Stocks Geekwire

How Biden S Build Back Better Hits Blue States Harder

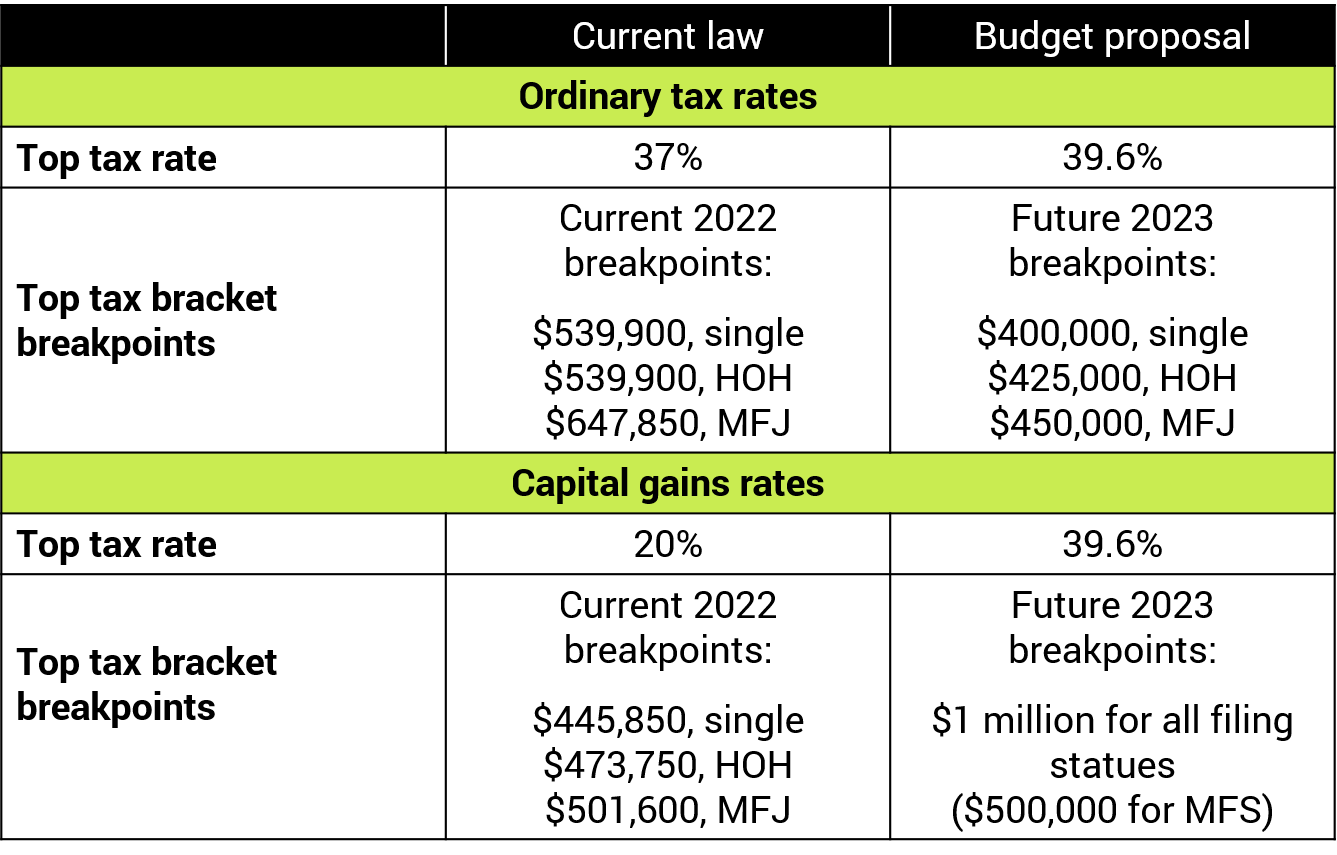

Biden Budget Tax Plan Raises Tax Rates To Highest In Developed World

Washington State Enacted Capital Gains Tax Currently Held To Be Unconstitutional 2021 Articles Resources Cla Cliftonlarsonallen

Sources Of Personal Income In The United States Tax Foundation

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

The Looming Capital Gains Tax Hike The Potential Impact On Businesses And Individuals Sc H Group

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

How Do State And Local Individual Income Taxes Work Tax Policy Center

Breaking Down Biden S Proposal On Long Term Capital Gains Advisor S Edge